Sept. 29, 2019

This is a peculiar trading strategy. The original author probably wanted it to be based on some Markowitz portfolio management principles, but it is not. Nonetheless, over part of its trading interval, it does make as much money doing nothing as it does trading.

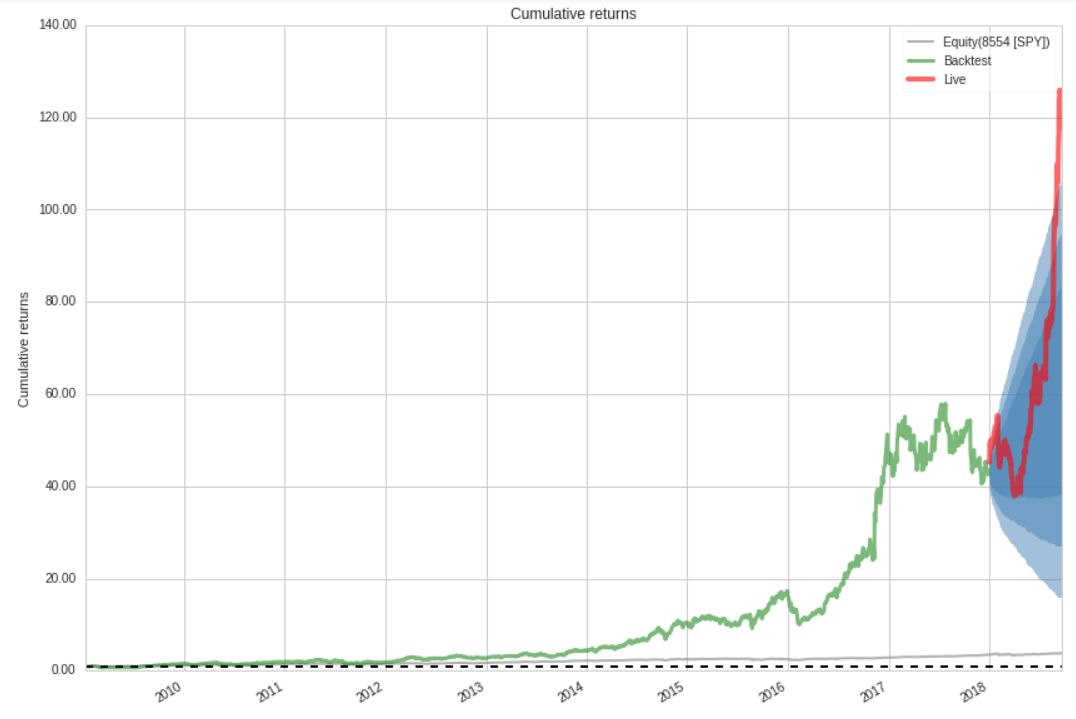

I have not found why, over some time intervals, it does not trade at all. For instance, prior to 2007, there were no trades, and just after October 2017, again, there were no trades. I limited the simulations from 2009/01/02 to 2018/09/21, even if they exceeded the October 2017 no-trading period.

Whatever the stock inventory was after October 2017, we could say the strategy went into hibernation or in a Buy & Hold scenario until termination time. From the charts below, it turned out to be quite profitable.

I usually get interested in trading strategies that can withstand 10 years or more. This one with 9 years barely qualifies. However, I was interested because its optimizer was the same as the one used in the first chart in this thread.

I added many changes to the original design giving it a totally different long-term outlook. Applying pressure where I thought it would add value. Thereby changing the nature of the betting system implemented. I increased the number of stocks to 28. And since the strategy was scalable, all trading profits were reinvested as the strategy progressed in time. I even used some leverage.

I have not as yet added protective measures. They should come next if I find the time. I consider the strategy as still in its development stage.

Here are the charts. First, the cumulative returns:

(click to enlarge)

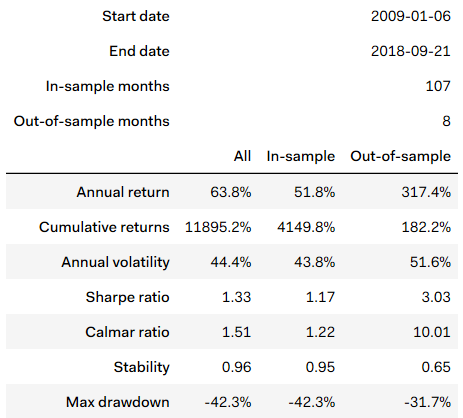

Some of the metrics:

(click to enlarge)

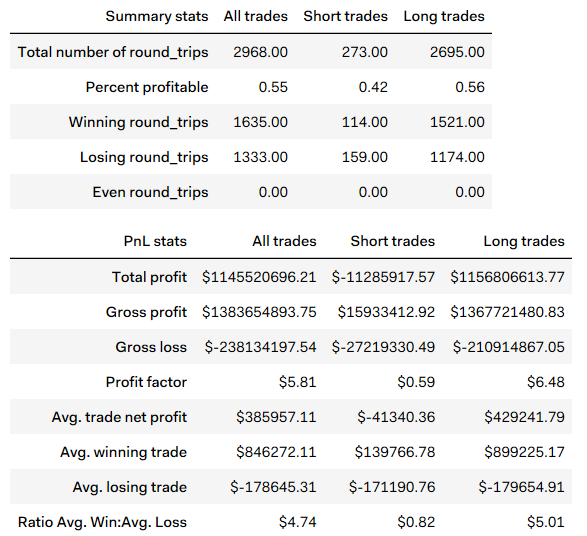

And summary stats:

(click to enlarge)

The strategy made 2,968 trades and managed to take its $10M initial stake up to $1.1B, a 63.8% CAGR over the 9 years.

I should be able to add protective measures that should increase overall performance as well as reduce drawdown. It is a pity I do not know why it stopped trading in October 2007. However, if it was some added feature, based on the results, I would be ready to keep it on the condition that it also works on other stock selection methods.

Prior to 2018, the strategy seemed ready to break down. Yet, letting it do whatever it did, which was nothing at all, proved a lot more lucrative.

Sept. 29, 2019, © Guy R. Fleury. All rights reserved.